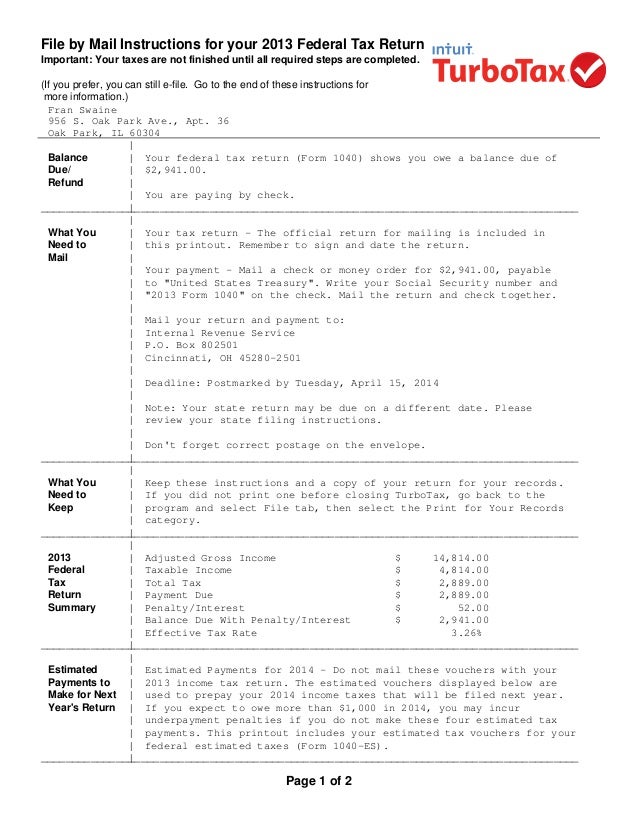

Just connect your wallets and exchanges and CoinLedger can generate an aggregated crypto tax report that you can easily import into TurboTax! What’s the best crypto tax software to use with TurboTax? In this case, TurboTax will have trouble calculating your capital gains and losses as it lacks the ability to track transfers between wallets and exchanges. Both Premier and Self-Employment support cryptocurrency tax reporting. Head to TurboTax Online and select your package. Navigate to TurboTax Online and select the Premier or Self-Employment package Here’s how you can report your cryptocurrency within the online version of TurboTax. How to enter crypto gains and losses into TurboTax Online This is why TurboTax has partnered with CoinLedger to help users aggregate crypto transactions across all of their wallets and exchanges and then import relevant tax forms directly into their TurboTax account. As a result, it doesn’t always have the integrations and functionality needed to make reporting your crypto taxes stress-free. While TurboTax is one of the best tax platforms on the market, it’s important to remember that it wasn’t built with cryptocurrency in mind. Yes, TurboTax allows users to report cryptocurrency taxes. Can I file cryptocurrency taxes on TurboTax?

In this guide, we’ll walk through a step-by-step process to report your bitcoin and cryptocurrency on TurboTax-both online and desktop versions.

0 kommentar(er)

0 kommentar(er)